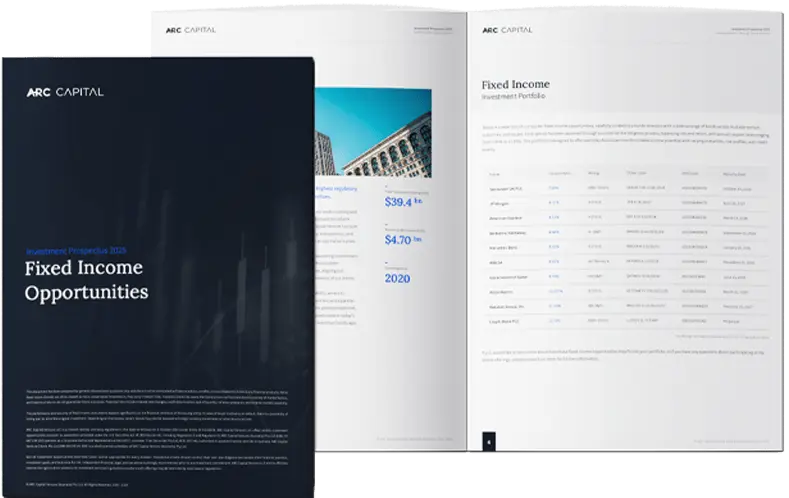

A Potentially Stable Income

Option For Individual Investors

Fixed income bonds can help Australians add stability to a diversified investment portfolio. They typically offer regular interest payments and lower volatility compared to some other asset classes. For investors seeking income with moderate risk, bonds may provide a useful component of a broader financial strategy. However, all investments carry risk and returns are not guaranteed.

Stable Income Potential

Fixed income bonds can offer regular interest payments, monthly, quarterly, or annually making them a potential source of income for investors seeking more predictable cash flow.

Lower Volatility

Bonds typically exhibit lower price volatility than equities and may offer fixed interest returns when held to maturity. However, all investments carry risk, including the risk of capital loss.

Capital Preservation

Holding bonds to maturity may return the initial investment, subject to issuer creditworthiness and market conditions. While considered lower risk than some alternatives, capital is not guaranteed.

Government & Corporate Bonds

Invest in a range of government and corporate bonds issued by third parties. Each bond carries different levels of risk and return, depending on the issuer and terms of the offer.